fast, flexible finance

for innovative businesses

Business is flexible by nature, but finance rarely is. One misstructured deal, slow lender or credit constraints can put a hard stop on a project that should already be underway.

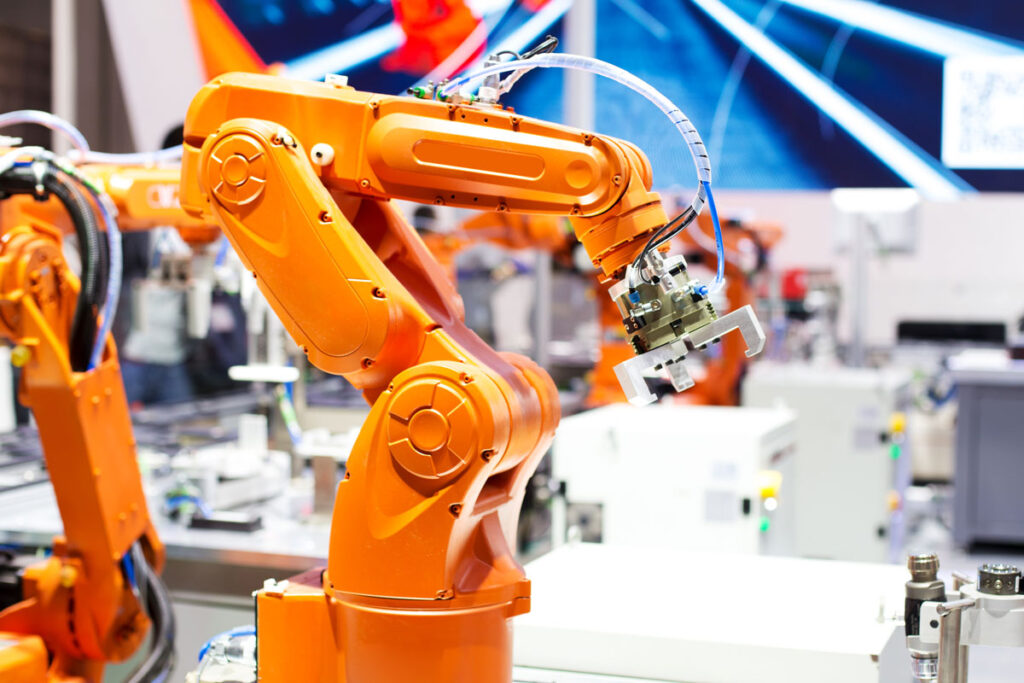

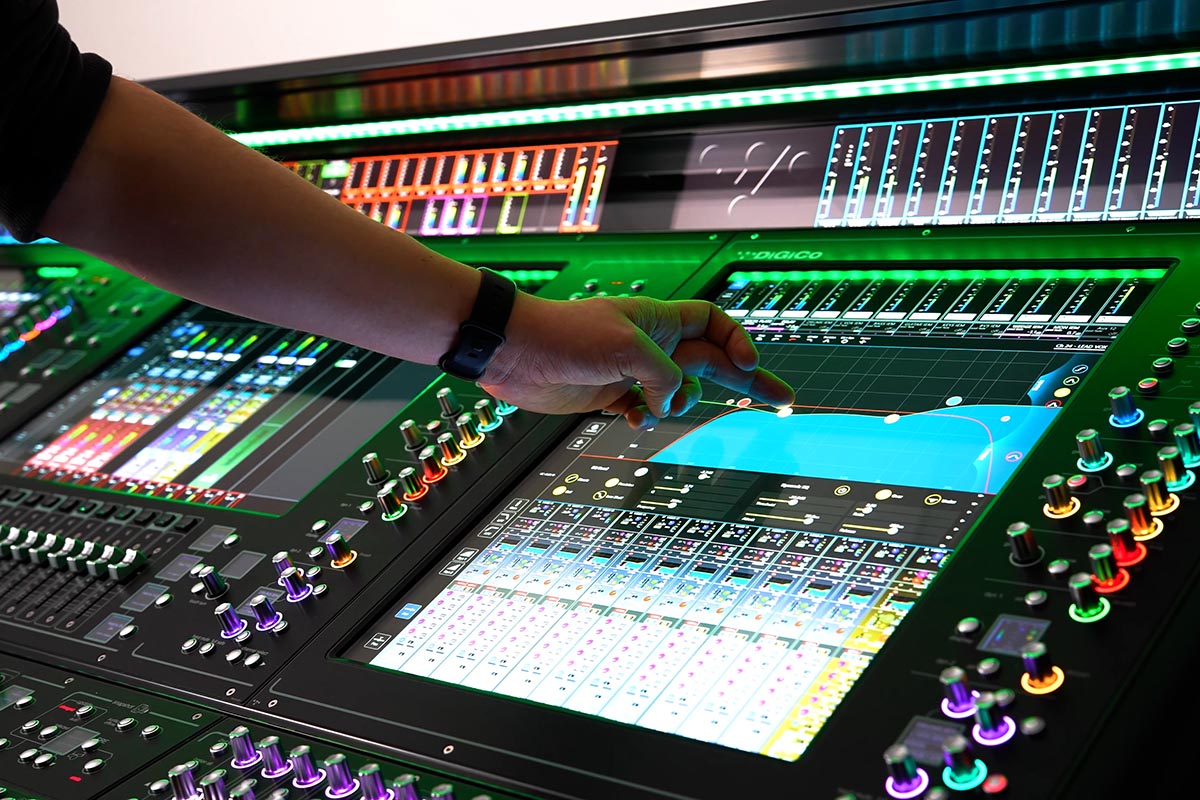

That’s where we come in. Whether you’re fitting out a new warehouse, expanding your vehicle fleet, purchasing new machinery or investing in specialist broadcast/AV/live entertainment equipment that sits outside most banks’ risk appetite, we work with you and our extensive panel of lenders to secure the kind of capital that drives business growth.

£65m+

financed in the past three years

30+ years

of experience

77%

of clients return to work with us

40+

lenders on our panel

Our flexible finance solutions

How to apply

Whether you’re a growing start-up or listed PLC, our three-step process gives you clarity, avoids wasted time on poorly structured deals and finds the best finance for your goals. Most clients receive a funding decision within 24-48 hours.

Tell us about your business and what you’re trying to achieve.

We’ll arrange a short conversation to discuss what you’re looking to fund, timings and your commercial goals. We’ll also ask for a few documents such as supplier quote/s, latest financials, most recent bank statements and ID to start the process.

Get matched to lender(s).

We identify the best lenders to provide your finance, whether it’s one or a strategic syndicate, and you’ll typically receive the recommended structure and terms within 1-2 days. We’re on hand to answer any questions and refine the approach.

Receive your offer.

We’ll submit your application and handle everything required for approval, from lender questions to additional document submission. We’ll keep you updated throughout and, once approved, will present your offer and assist with the final paperwork so funds can be released.

Your dedicated

funding partners

Our specialist team, founded by Gavin Scott and Ramona Culea, has spent over three decades securing finance for notoriously complex assets. Our roots in creative equipment funding mean we know how to justify asset value and structure finance that moves through credit cleanly – which is why so many of our client relationships span decades. When you work with us, you work with partners who:

Understand your assets and funding cycles – you get a deal that suits your way of working with fair pricing

We don’t work standard hours – your next project or expansion is never held up by only being able to talk to someone from 9 to 5

Increase your businesses funding potential – with 40+ lenders on our panel, we widen your finance options beyond big bank risk appetites

Manage the process end-to-end – so you can focus on your day job

Design each deal around your business – avoiding one-size-fits-all funding delays and frustrations

Latest promotions

SONY

Interest Free 24 months