Financing a record-breaking tour with bespoke repayment terms: Urban Audio

About Urban Audio

Urban Audio Productions has been operating at the top end of the UK live events industry since 2000. Founded by Warren Fisher and Dan Lewis, the Solihull-based business supplies audio, lighting and AV systems for high-profile touring acts, festivals and corporate conferences.

It owns and deploys quality equipment at scale and provides end-to-end support for technically complex shows, with preparation often beginning weeks before going live.

The challenge

In early 2024, Urban Audio was preparing for the largest project in the business’s history: a nine-month global tour across multiple territories.

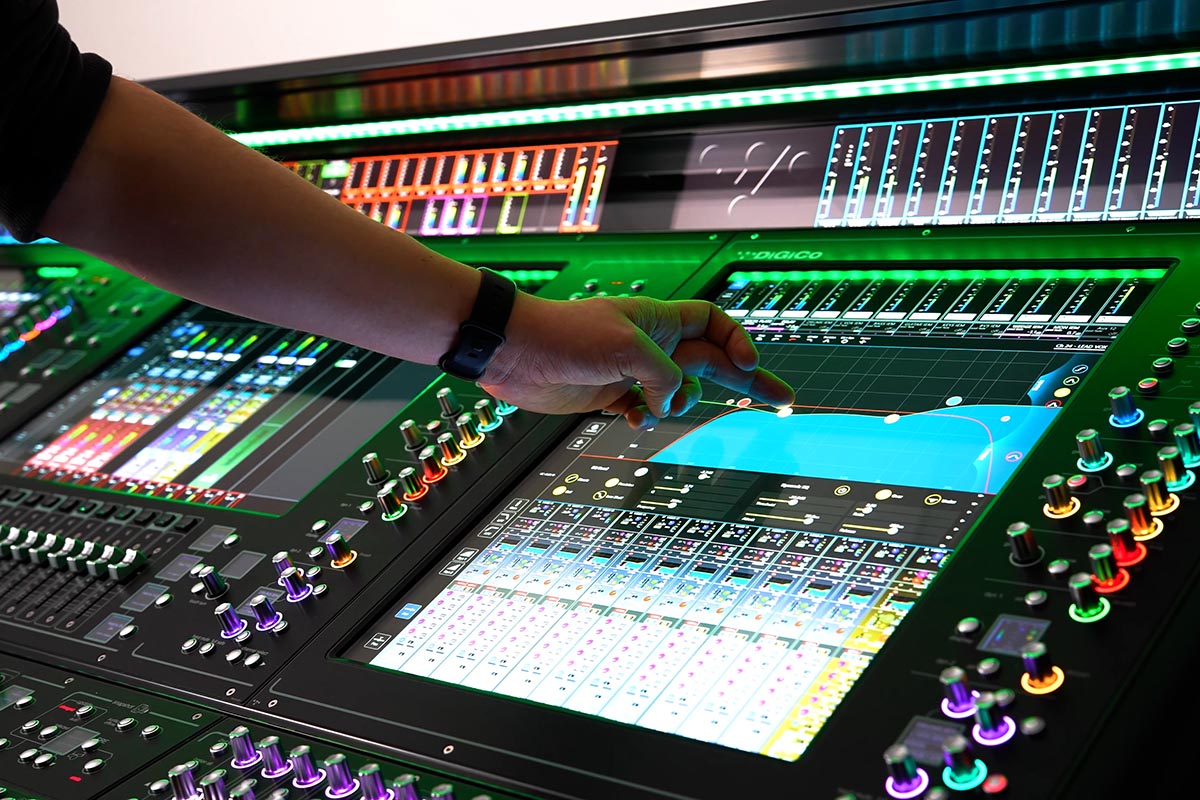

As soon as the contract was confirmed, the team knew additional equipment was required. Front-of-house Digico & Yamaha mixing consoles, Shure radio mics and stage systems all needed to be purchased and delivered months before rehearsals started – and long before the tour began generating income.

That timing created pressure. Touring suppliers are typically paid in stages across tour legs, with relatively little coming in during the preparation phase. Waiting to fund the purchase from tour revenue wasn’t realistic. But buying the equipment outright would have pulled a significant amount of working capital out of the business.

Urban Audio came to Catalyst with one question: can we finance equipment months before we have the income to service standard loan repayments?

The solution

Our initial work focused on understanding the specifics of how the project would run in practice – not just on paper. We worked through equipment commitments, rehearsal timelines and supplier payment points with Urban Audio to identify where cash pressure would sit.

Armed with an understanding of the overall equipment requirement and when different parts of the system would be deployed, we went out to our extensive panel of lenders to find a flexible deal that would meet Urban Audio’s needs – a large investment, staged over several years, with lower repayments at the start of the agreement. The final structure included:

- Bespoke repayment profiles aligned to the tour schedule, with minimal repayments during rehearsals, stepped increases once live dates began and deliberately higher payments during defined periods to match stronger tour cash inflows

- Facilities across more than one lender to support the flexible, non-standard repayment requirements

- VAT deferral timed to tour deposits, so tax payments were due after the first major tour receipts were received.

Throughout the process, our team handled lender negotiations and applications, translating the realities of touring into terms funders could support while keeping Urban Audio out of the day-to-day detail.

The results

As a result of the funding structure we arranged, Urban Audio was able to:

- Commit to its largest touring project to date with confidence

- Maintain service to existing clients alongside the tour, instead of tying up equipment or capital in a single project

- Focus on technical delivery and production readiness rather than cash constraints

- Deliver a technically complex, high-profile tour at scale, reinforcing Urban Audio’s position at the top end of the live events market and supporting future touring opportunities.

At a glance…

Asset

Mixing consoles, Sound kit

Finance Solution

Hire Purchase

Finance Term

3 years

Industry

Live entertainment

We genuinely wouldn’t have been able to deliver on this tour without Gavin and his team. The customisation of the finance period was integral to our success and there’s no way we could’ve negotiated the same terms directly with the lenders.”

Warren Fisher, Managing Director, Urban Audio

If you’re considering funding for a new asset, project or expansion, our team can walk you through the likely costs and options for your business. Book a time to talk with us today.